|

| ACTUARIAL NEW NORMAL IN

RETIREMENT VALUATION(PAS 19) |

|

|

|

|

| KEY ACTUARIAL INTELLIGENCE, INC. |

| is here to help companies analyze and revisit

retirement liabilities and expense by refining the assumptions to cater to the NEW NORMAL brought about by Covid 19. |

|

|

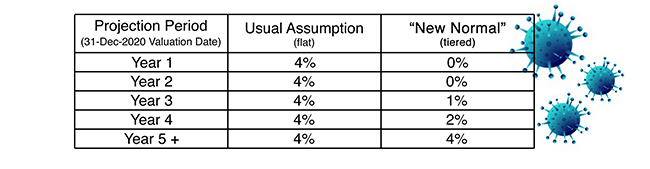

| 1. Salary Increase Assumption |

| Usually this is a flat rate at, say, 4% per year for the rest of the projection period. However, we understand that the new normal necessitates re-calibration of pay structure for the next few years. As such, the relevant assumption could be tiered across the years starting with 0% for the first year of projection then steadily increasing to an ultimate rate. |

|

| The tiered salary increase assumption will better reflect the new normal and provide relief on the expense side. Moreover, the salary increase rate assumption could even be calibrated across different employee classes to further fine tune the results.

|

|

|

| 2. | Recalibration of the resignation rates | |

| The resignation rates may need to be revisited to better reflect the recent historical data taking into account the new normal. |

|

|

|

| 3. | Significant manpower reduction | |

| The effect of the manpower reduction could also be imputed to lower the post-employment

expenses. |

|

|

|

|

|

|

| Rest assured that our actuarial valuation programs and methodologies are robust and flexible to handle needed assumption recalibration for the NEW NORMAL.

Please contact us for a proposal. |

|

|

|

|